Table of contents

Average customer acquisition cost by industry: 2026 benchmarks

Jan 19, 2026

6 mins read

Written by Imrana Essa

Are you paying too much to acquire each customer, or just operating in a high-cost industry?

The average customer acquisition cost varies dramatically by business model, channel, and market, and misunderstanding it can quietly kill profitability. Whether you run a SaaS platform or manage an e-commerce brand, knowing how your CAC compares to industry benchmarks is crucial to building an effective customer acquisition strategy.

This guide breaks down what the average customer acquisition cost looks like across industries in 2026 and how to calculate it accurately. You’ll also get to know which benchmarks matter most and how to lower CAC without hurting long-term profitability.

What is the average customer acquisition cost (CAC)

Customer acquisition cost (CAC) refers to the total investment a company makes to turn a prospect into a paying customer. It is one of the most important metrics in marketing analytics, offering clear visibility into how efficiently your sales and marketing operations are performing.

The total investment includes all costs related to sales and marketing efforts over a defined period, such as ad spend, employee salaries, software tools, and creative production.

Tracking CAC allows teams to:

- Shows how efficiently sales and marketing budgets convert into customers

- Helps identify high- and low-performing acquisition channels

- Informs campaign ROI, budgeting, and growth forecasting

- Acts as an early warning signal when acquisition becomes unsustainable

The average customer acquisition cost varies significantly by industry due to differences in sales cycles, pricing, and buyer behavior:

- E-commerce brands: Often lower CAC ($50–$100) due to fast purchase decisions

- B2B SaaS companies: Higher CAC ($200–$700+) because of longer sales cycles

- Enterprise & regulated industries: Can exceed $1,000 per customer

How to calculate customer acquisition cost

The standard formula to calculate average customer acquisition cost is:

To use this formula accurately, define a specific time period, monthly, quarterly, or annually, and make sure both the cost and customer count reflect the same timeframe.

For example, if your business spent $40,000 on marketing and sales last quarter and gained 160 new customers, your average CAC would be:

$40,000 ÷ 160 = $250 per customer

While the formula itself is simple, applying it accurately across channels and time periods is where many teams struggle. Customer acquisition cost is often built from multiple inputs, including cost per acquisition (CPA) at the campaign level. CPA is commonly used in performance marketing to track campaign-level efficiency.

To make this easier, Usermaven offers a free CPA calculator that helps you calculate acquisition costs by channel, which you can then use as a reliable input when determining your overall CAC.

Drive business growth

with AI-powered analytics

*No credit card required

What is considered a good customer acquisition cost?

A good customer acquisition cost (CAC) is one that is sustainable relative to customer lifetime value (LTV). In most industries, a healthy benchmark is an LTV:CAC ratio of 3:1 or 4:1, meaning your business earns $3–$4 for every $1 spent on acquisition. In simple terms, your CAC should generally be no more than one-third of your LTV.

If your ratio falls below 3:1, acquisition may be unprofitable. If it’s consistently above 6:1, you may be under-investing in growth opportunities. Some industries, such as investment platforms and trading services, often achieve higher ratios due to recurring revenue models, which is why recommended copy trading platforms typically prioritize strong customer lifetime value metrics.

Factors impacting customer acquisition cost

Several variables influence how high or low your CAC will be:

- Industry and business model (B2B vs B2C, SaaS vs e-commerce)

- Length and complexity of the sales cycle

- Marketing channels used (paid ads, organic search, referrals)

- Conversion rates across your funnel

- Level of competition in your market

- Overhead costs tied to acquisition efforts

- Customer retention and repeat purchase behavior

Average customer acquisition cost by industry in 2026

Customer acquisition costs vary significantly not just by industry but also by how customers are acquired. In most businesses, CAC comes in two forms:

- Organic CAC, from channels like SEO, content marketing, referrals, and email

- Paid CAC, from paid search, social ads, display ads, and sponsorships

Understanding both types helps you benchmark your acquisition performance realistically in 2026.

CAC by industry in 2026: Overview

| Industry | Average Organic CAC | Average Paid CAC | Average Combined CAC |

| Higher Education | ~$862 | ~$1,985 | ~$1,423 |

| Legal Services | ~$584 | ~$1,245 | ~$915 |

| Financial Services | ~$644 | ~$1,202 | ~$923 |

| Real Estate | ~$660 | ~$1,185 | ~$923 |

| Manufacturing | ~$662 | ~$905 | ~$784 |

| Business Consulting | ~$410 | ~$901 | ~$656 |

| Commercial Insurance | ~$590 | ~$600 | ~$595 |

| IT & Managed Services | ~$325 | ~$840 | ~$583 |

| Transportation & Logistics | ~$436 | ~$732 | ~$584 |

| Medical Device | ~$501 | ~$755 | ~$628 |

| Entertainment & Media | ~$190 | ~$468 | ~$329 |

| B2B SaaS | ~$205 | ~$341 | ~$273 |

| Pharmaceutical | ~$196 | ~$160 | ~$178 |

| E-commerce (Retail) | ~$87 | ~$81 | ~$84 |

CAC benchmarks for B2B vs B2C sectors

Customer acquisition costs vary widely across industries, and the difference between B2B and B2C models is particularly stark. B2B companies tend to have higher CAC due to longer sales cycles and more complex buyer journeys, while B2C brands often benefit from shorter purchase decisions and broader reach through paid media.

- Higher Education: ~$1,400

- Legal Services: ~$900–$950

- Financial Services: ~$900+

- Commercial Insurance: ~$590

- B2B SaaS: ~$270–$300

In comparison, B2C businesses generally operate with much lower CAC, driven by shorter funnels and impulse-friendly buying behavior:

- E-commerce (Retail): ~$80–$90

- Entertainment & Media: ~$300–$330

- Food & Beverage (D2C): ~$80–$100

- Fashion & Apparel: ~$90–$120

- Beauty & Personal Care: ~$90–$130

Comparing your results to these industry averages through acquisition reports helps benchmark performance. It also reveals whether your acquisition strategy is spending efficiently.

What is the average customer acquisition cost for SaaS?

The average customer acquisition cost for SaaS companies varies widely by vertical, target market, and sales complexity. SaaS CAC typically ranges from under $300 to well over $1,000, with highly regulated or enterprise-focused products at the upper end.

These elevated costs reflect the longer sales cycles, product education requirements, and personalization that define most SaaS customer journeys. In many B2B environments, acquisition costs are also influenced by saas contract management, as teams need to manage complex subscription terms, renewals, and multi-year agreements before a customer converts.

Average customer acquisition cost for SaaS by industry

| SaaS Industry | Average CAC |

| Fintech | $1,450 |

| Insurance | $1,280 |

| Medtech | $921 |

| Security | $805 |

| Agtech | $712 |

| Cleantech | $674 |

| Design | $658 |

| Adtech | $560 |

| Engineering | $551 |

| Industrial | $542 |

| Proptech | $518 |

| Staffing & HR | $410 |

| Legaltech | $299 |

| eCommerce SaaS | $274 |

These figures represent the average combined CAC and should be used as directional benchmarks rather than fixed targets.

What is the average customer acquisition cost for e-commerce brands?

E-commerce brands tend to have lower average CAC, but performance can vary significantly based on product type, price point, and customer retention strategy:

- Food & Beverage: ~$80–$100

- Beauty and Body Treatment: ~$90–$130

- Fashion & Apparel: ~$90–$120

- Electronics: ~$100–$150

- Jewelry: ~$120–$180

While these numbers are generally lower than SaaS, the margins in e-commerce are often tighter. That makes tracking CAC, alongside return rates and customer lifetime value, critical to profitability. With Usermaven, e–commerce brands can monitor CAC by source, optimize campaign spend, and build more profitable acquisition strategies without relying on siloed data.

Strategies to improve your customer acquisition cost

Lowering your customer acquisition cost doesn’t mean slashing budgets; it means making your acquisition efforts more efficient. From optimizing your funnel to using automation and long-term content strategies, here are proven ways to reduce CAC and drive profitable growth.

1. Funnel optimization and conversion rate improvements

Improving your conversion rates is one of the most direct ways to lower CAC. Even small changes to landing pages, onboarding flows, or checkout experiences can lead to significant gains in customer acquisition without increasing your spend.

For example, A/B testing headlines, CTAs, or pricing displays can help move more users through the funnel. In e-commerce, simplifying the checkout process can dramatically boost conversion rates. For SaaS, removing friction in trial sign ups for JungleScout or demo booking forms can reduce drop-off and increase lead-to-customer conversion.

2. Smart audience targeting and retargeting strategies

Refining who sees your ads directly improves your CAC. By using advanced segmentation such as behavioral, demographic, psychographic, and intent-based targeting you can reduce wasted spend and focus your budget on users who are most likely to convert.

Retargeting is another high-leverage tactic. Visitors who already know your brand often convert at 2–3× higher rates than cold traffic. Whether through email, display ads, or social, retargeting keeps your brand top-of-mind while improving conversion efficiency.

With Usermaven’s segments, you can identify high-performing audiences and allocate your budget to what works.

3. Marketing automation and referral systems

Marketing automation reduces CAC by minimizing manual effort across the funnel. Automated email sequences, lead-nurturing workflows, and behavior-based messaging help move prospects toward conversion without requiring extra team bandwidth.

Referral programs are another efficient channel. Customers acquired through referrals often have 20–40% lower CAC and higher lifetime value. Offering incentives for both referrer and referee encourages participation and drives cost-effective growth.

Usermaven helps you track the CAC impact of automated sequences and referral campaigns, ensuring they perform at scale.

4. Content-led acquisition to reduce long-term CAC

Content marketing is one of the most sustainable ways to lower CAC over time. Educational blog posts, SEO-optimized landing pages, product tutorials, and downloadable resources build organic traffic and authority, driving leads without ongoing ad spend.

For SaaS businesses, in-depth guides and case studies attract high-intent prospects. For e-commerce, content around lifestyle, product use, user-generated content, or trends can boost engagement.

Unlike paid ads that stop performing the moment the spend ends, great content continues to deliver traffic and conversions long after it’s published. Usermaven helps measure how content contributes to CAC reduction through multi-touch attribution and funnel tracking.

How Usermaven helps reduce and optimize customer acquisition cost

Usermaven is designed for teams that want clearer visibility into how acquisition spend turns into customers. Here’s how it helps teams understand, track, and improve CAC.

Real-time visibility into CAC drivers across channels

Many teams struggle to understand which channels are actually driving efficient customer acquisition. Usermaven helps by connecting conversion data with acquisition sources, making it easier to evaluate CAC by channel.

- View acquisition performance across paid, organic, referral, and email channels

- Monitor how spend and conversions change over time

- Identify channels that consistently drive higher or lower acquisition costs

This visibility allows teams to spot inefficiencies early, adjust budgets faster, and avoid waiting for delayed or manual reports.

Attribution analysis for more efficient CAC optimization

Lowering CAC requires understanding how customers convert, not just where they come from. Usermaven’s attribution software shows how different touchpoints contribute to conversions across the customer journey.

- Understand the role of first-touch, last-touch, and supporting channels

- Identify campaigns that influence conversions beyond the final click

- Shift budget toward channels that drive higher-quality customers

With clearer attribution, teams can reduce wasted spend and focus on efforts that improve CAC without sacrificing volume.

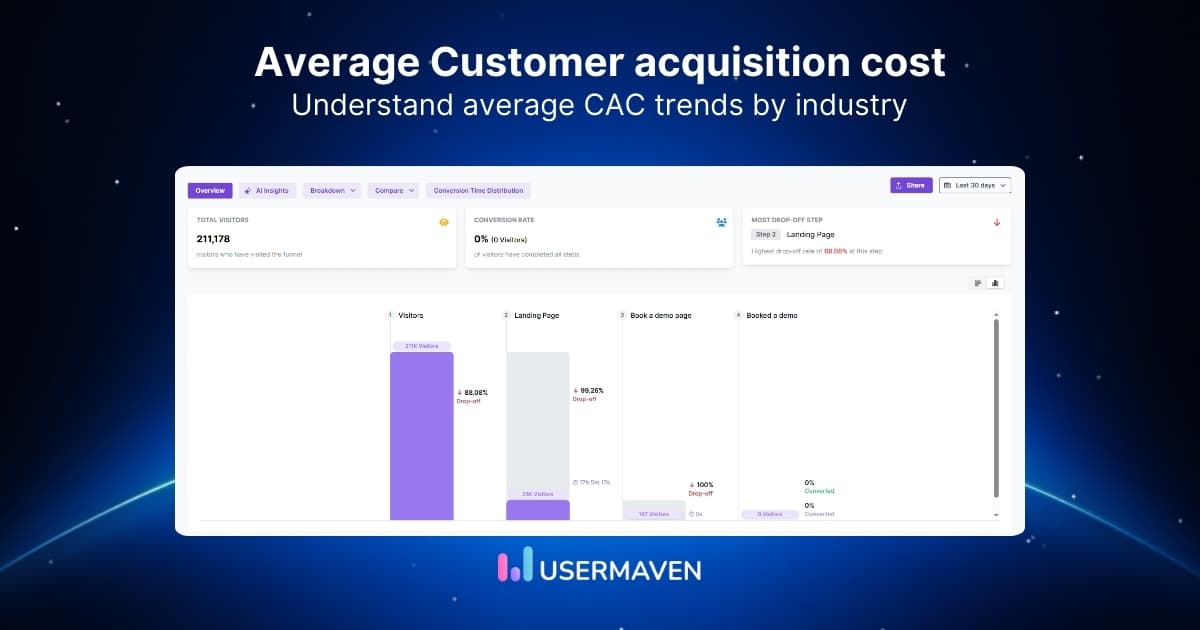

Funnel insights that help reduce acquisition waste

Funnel drop-offs directly increase customer acquisition cost. Usermaven’s funnel analysis helps teams see where prospects disengage and where improvements will have the biggest impact.

- Track conversion rates across key funnel stages

- Identify friction points in trials, sign-ups, or checkout flows

- Compare funnel performance by channel or audience segment

For example, SaaS teams can pinpoint where trial users drop off, while e-commerce brands can identify checkout friction that inflates CAC. Improving these stages increases conversions from existing traffic, lowering CAC without increasing spend.

See Usermaven in action

Book a free demo and discover how powerful analytics can grow your business.

*No credit card required

Bottom line!

Customer acquisition cost is more than a performance metric; it’s a reflection of how efficiently your growth strategy works. When you understand your CAC in context, compare it against industry benchmarks, and track how it changes over time, you gain clearer control over profitability and scale.

Usermaven helps solve this by giving teams accurate visibility into acquisition performance, attribution, and funnel behavior. As industry leading website analytics tool, it connects spend, channels, and conversions so you can understand what’s driving CAC and where optimization will have the biggest impact.

Ready to make smarter decisions around acquisition and growth?

Sign up or book a demo today with Usermaven to get the clarity without complexity.

FAQs about average customer acquisition cost

1. What is considered a good CAC in 2026?

A “good” CAC depends on your business model and industry. The key benchmark is your LTV: CAC ratio; aim for at least 3:1. For example, if a customer is worth $900 over their lifetime, spending $300 or less to acquire them is considered sustainable. SaaS businesses may accept higher CAC if retention is strong; e-commerce brands typically need lower CAC due to thinner margins.

2. How often should you track your CAC?

You should track CAC continuously, not just monthly or quarterly. Real-time tracking allows your team to catch inefficiencies early and make fast adjustments. With tools like Usermaven, you can monitor CAC daily by campaign or channel, enabling more agile decisions.

3. Why tracking customer acquisition cost is essential for your business?

Tracking customer acquisition cost is essential because it shows how efficiently your business turns marketing and sales spend into paying customers. It helps you control profitability, plan budgets more accurately, and identify which channels drive sustainable growth.

4. Does a lower CAC always mean better performance?

Not always. A very low CAC might indicate underinvestment or missed growth opportunities. What matters most is the balance between CAC and customer lifetime value (LTV). If your CAC is too low but LTV is also low, you’re not maximizing revenue potential. Aim for a healthy LTV: CAC ratio rather than chasing the lowest CAC.

5. Can CAC be calculated per channel?

Yes, CAC should be calculated per channel. Calculating CAC per channel helps you understand which acquisition sources are most efficient. For example, your CAC from email marketing may be far lower than from paid social.

Try for free

Grow your business faster with:

- AI-powered analytics & attribution

- No-code event tracking

- Privacy-friendly setup